Take a closer look

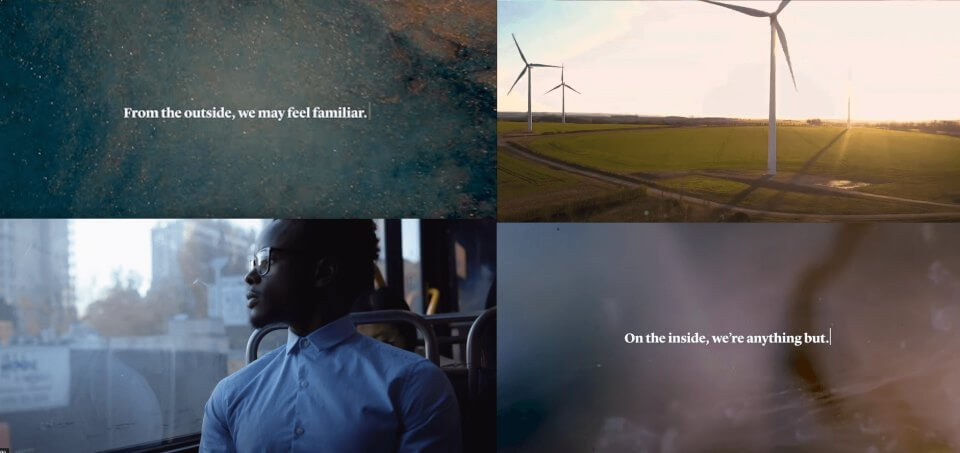

From the outside, we may seem familiar.

On the inside, we’re anything but.

Working for us

Here, your actions and ideas come to life in exciting and meaningful ways. Ours is a story of evolution, a journey we can go on together. Ours is a culture of trust and collaboration, genuinely caring about society and one another. At Legal & General, your story will be anything but familiar.

Read more

Our businesses

There’s so much more to us than meets the eye. We’re insurers, investors, builders, city-regenerators and green technology champions. And whatever the future holds, our people’s knowledge, skill and passion will mean we’re placed to make a real difference to society.

Read moreOur latest roles

Salary

Location

London

Business Unit

Legal & General Investment Management

Job Family

Solutions Group

Location

London

Full Time/Part Time

Full-time

Permanent/Fixed Term Contract

Permanent

Description

As an Assistant Portfolio Manager in the Buy and Maintain team at LGIM you will play a key role in the management of a broad range of investment grade credit portfolios. Collaborating with teams acros

Reference

680eb525-4731-4612-b077-9f90018701f8

Expiry Date

01/01/0001

Salary

Location

Brighton and Hove

Business Unit

Legal & General Group Functions

Job Family

IT & Change

Location

Hove

Full Time/Part Time

Full-time

Permanent/Fixed Term Contract

Permanent

Description

What you'll be doing Join us on a 24 month programme which includes support to study for an industry recognised Level 4 Cyber Security Technologist Qualification, whilst building your business acumen

Reference

58b67cba-bd1e-4f8a-a52c-25e96c3fe667

Expiry Date

01/01/0001

Salary

Location

London

Business Unit

Legal & General Investment Management

Job Family

Product

Location

London

Full Time/Part Time

Full-time

Permanent/Fixed Term Contract

Fixed Term Contract

Description

Product management. Lead and ensure each product and fund range is fully managed following launch through to the end of its lifecycle, adhering at all times to the Product Process Manual and Product L

Reference

88087ebf-251e-4fe3-a83f-e8a897f6e4a5

Expiry Date

01/01/0001

Our purpose

At Legal & General, we’re building a better society and improving the lives of our customers. To do this we’re investing in long-term assets that benefit everyone from housing to renewable energy – we call it inclusive capitalism. This shapes the way we invest, plan, hire and do business.

Read moreOur latest posts

Teaser

Our peopleContent Type

BlogPublish date

04/08/2024

Summary

Shifting gears in your career isn't just about making a decision; it's a chance to chart a new course, unlock new challenges and make a real impact. If you’ve got your sights set on the UK, you

Teaser

Our peopleContent Type

BlogPublish date

04/05/2024

Summary

Legal & General is commited to building an even more diverse, inclusive workplace – one where everyone thrives. Our second Britain’s Most Admired Company win is a recent recognition of this, wit

+(2).jpg)

Teaser

Our peopleContent Type

BlogPublish date

04/03/2024

Summary

If you're familiar with Legal & General Investment Management, you know that our mission is to create a better future through responsible investing. LGIM is our global asset management business,

Teaser

Our peopleContent Type

BlogPublish date

02/08/2024

Summary

Are you weighing up the option of apprenticeship versus university? You’re not alone. Dan Molloy was in this exact position. He knew he wanted a qualification, but he was stuck wondering which r

Teaser

Our peopleContent Type

BlogPublish date

02/08/2024

Summary

Legal & General runs apprentice programmes to kick-start careers in Data, Technology, Accounting, Customer Service, Project Management, Business Analysis and Financial Crime. From school or coll

Teaser

Our peopleContent Type

BlogPublish date

02/08/2024

Summary

Legal & General runs apprentice programmes across London, Cardiff and Hove, welcoming talent to an enterprise-wide community which shares ideas and learning in a supportive environment. The prog

Teaser

Our peopleContent Type

BlogPublish date

08/25/2023

Summary

Tim started his apprenticeship with us five years ago. He had never imagined himself working at a company like Legal & General – but was open to a different experience from his family and took t

Teaser

Our peopleContent Type

BlogPublish date

08/25/2023

Summary

I've been at L&G running the affordable homes business for just over 3-years now. Starting from scratch, me and my co-workers have built a business of 115 people delivering great quality affordable ho

Teaser

Our peopleContent Type

BlogPublish date

08/25/2023

Summary

For Toby, supporting a greater purpose isn’t a tick-box activity. He gets back from his giving. Interested to hear more about Toby and how he’s made a positive impact as part of his role at Legal &

Teaser

Our peopleContent Type

BlogPublish date

08/25/2023

Summary

I’m a passionate advocate of life-long learning. Often when someone leaves school or university, they assume that learning is over and done with, but that should not be the case. My role in the Learni

Be a part of it

Regardless of your area of expertise, joining Legal & General is the beginning to a future that will be anything but familiar. So take a closer look, get involved, be curious and find out how we will enable you to be at your best no matter who you are.